Debt to Equity Ratio Formula Analysis Example

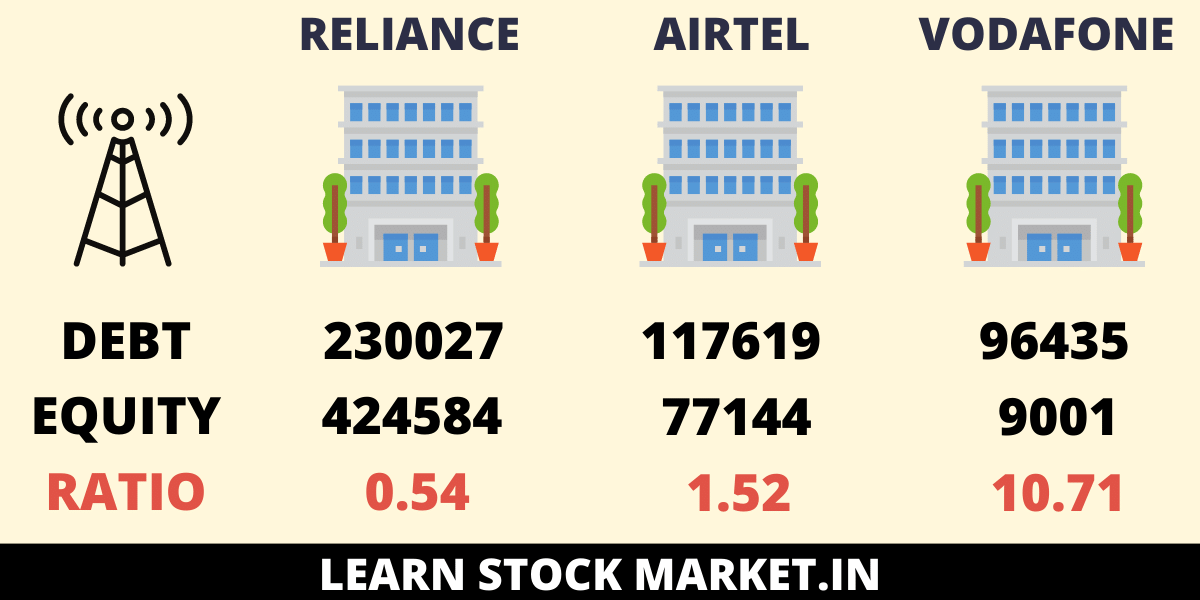

A debt-to-equity-ratio that’s high compared to others in a company’s given industry may indicate that that company is overleveraged and in a precarious position. A company’s ability to cover its long-term obligations is more uncertain, and is subject to a variety of factors including interest rates (more on that below). When looking at a company’s balance sheet, it is important to consider the average D/E ratios for the given industry, as well as those of the company’s closest competitors, and that of the broader market. The interest paid on debt also is typically tax-deductible for the company, while equity capital is not.

How does the D/E ratio affect investors?

Using the D/E ratio to assess a company’s financial leverage may not be accurate if the company has an aggressive growth strategy. If a company’s D/E ratio is too high, it may be considered a high-risk investment because the company will have to use more of its future earnings to pay off its debts. Tesla had total liabilities of $30,548,000 and total shareholders’ equity of $30,189,000. This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used. The debt capital is given by the lender, who only receives the repayment of capital plus interest.

InvestingPro: Access Debt to Equity Ratio Data Instantly

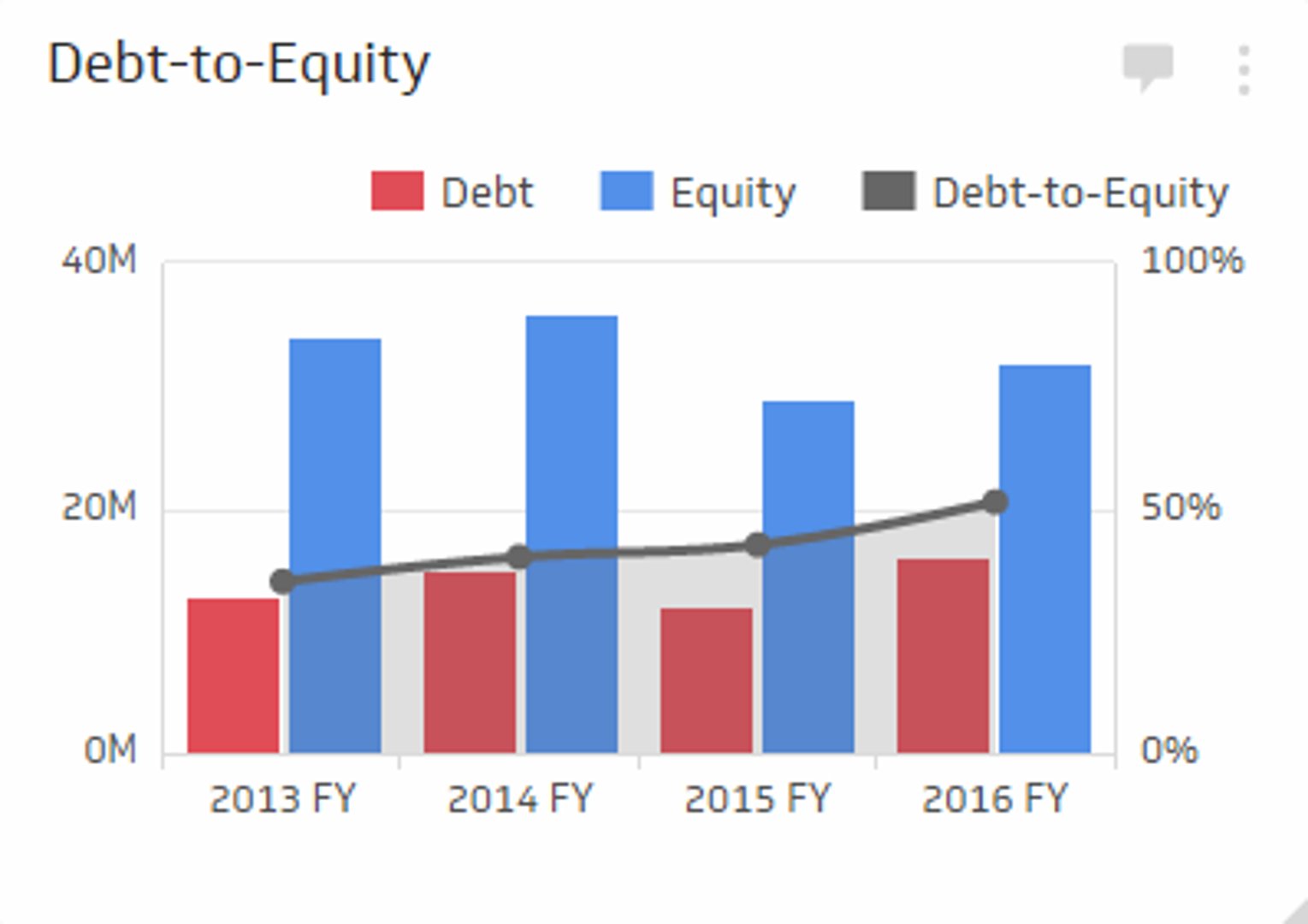

Trends in debt-to-equity ratios are monitored and identified by companies as part of their internal financial reporting and analysis. The debt-to-equity ratio is a financial ratio that measures how much debt a company has relative to its shareholders’ equity. It can signal to investors whether the company leans more heavily on debt or equity financing. A company with a high debt-to-equity ratio uses more debt to fund its operations than a company with a lower debt-to-equity ratio.

Debt to Equity Ratio Calculation Example

The debt-to-equity ratio (D/E) is a financial leverage ratio that can be helpful when attempting to understand a company’s economic health and if an investment is worthwhile or not. It is considered to be a gearing ratio that compares the owner’s equity or capital to debt, or funds borrowed by the company. Short-term debt also increases a company’s leverage, of course, but because these liabilities must be paid in a year or less, they aren’t as risky. We can see below that for Q1 2024, ending Dec. 30, 2023, Apple had total liabilities of $279 billion and total shareholders’ equity of $74 billion. Understanding the average roadmap and milestones in your industry helps contextualize your company’s financial standing.

The debt-to-asset ratio measures how much of a company’s assets are financed by debt. With debt-to-equity ratios and debt-to-assets ratios, lower is generally favored, but the ideal can vary by industry. The concept of a “good” D/E ratio is subjective and can vary significantly from one industry to another. Industries that are capital-intensive, such as utilities and manufacturing, often have higher average ratios due to the nature of their operations and the substantial amount of capital required. Therefore, it is essential to align the ratio with the industry averages and the company’s financial strategy.

InvestingPro: Access Debt-to-Equity Ratio Data Instantly

In most cases, this would be considered a sign of high risk and an incentive to seek bankruptcy protection. What counts as a “good” debt-to-equity (D/E) ratio will depend on the nature of the business and its industry. Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky. Companies in some industries, such as utilities, consumer staples, and banking, typically have relatively high D/E ratios.

Not all debt is considered equally risky, however, and investors may want to consider a company’s long-term versus short-term liabilities. Generally speaking, short-term liabilities (e.g. accounts payable, wages, etc.) that would be paid within a year are considered less risky. The term “leverage” reflects the hope that the company will be able to use a relatively small amount of debt to boost its growth and earnings. Wise use of debt can help companies build a good reputation with creditors, which, in turn, will allow them to borrow more money for potential future growth. Companies also use debt, also known as leverage, to help them accomplish business goals and finance operating costs. Calculating a company’s debt-to-income ratio requires a relatively simple formula investors can use on their own or with a spreadsheet.

If they’re low, it can make sense for companies to borrow more, which can inflate the debt-to-equity ratio, but may not actually be an indicator of bad tidings. If preferred stock appears on the debt side of the equation, a company’s debt-to-equity ratio may look riskier. Having to make high debt payments can leave companies with less cash on hand to pay for growth, which can also hurt the company and shareholders. And a high debt-to-equity ratio can limit a company’s access to borrowing, which could limit its ability to grow.

- However, if the company were to use debt financing, it could take out a loan for $1,000 at an interest rate of 5%.

- When making comparisons between companies in the same industry, a high D/E ratio indicates a heavier reliance on debt.

- For example, if a company’s total debt is $20 million and its shareholders’ equity is $100 million, then the debt-to-equity ratio is 0.2.

- It can signal to investors whether the company leans more heavily on debt or equity financing.

She has ghostwritten financial guidebooks for industry professionals and even a personal memoir. She is passionate about improving financial literacy and believes a little education can go a long way. You can connect with her on Twitter, Instagram or her website, CoryanneHicks.com. If you’re an equity investor, you should care deeply about a firm’s ability to make debt obligations, because common stockholders are the last to receive payment in the event of a company liquidation.

But a D/E ratio above 2.0 — i.e., more than $2 of debt for every dollar of equity — could be a red flag. Again, context is everything and the D/E ratio is only one indicator of a company’s health. Banks and other lenders keep tabs on what healthy debt-to-equity ratios look like in a given industry.

This second classification of short-term debt is carved out of long-term debt and is reclassified as a current liability called current portion of long-term debt (or a similar name). The remaining long-term debt is used in the numerator of the long-term-debt-to-equity ratio. Taking a broader view of a company and understanding the industry its in and how it operates can help to correctly interpret its D/E ratio. For example, utility companies might be required to use leverage to purchase costly assets to maintain business operations. But utility companies have steady inflows of cash, and for that reason having a higher D/E may not spell higher risk.