Salvage Value Meaning, Formula How to Calculate?

If a company believes an item will be useful for a long time and make money for them, they might say it has a long useful life. Book value and salvage value are two different measures of value that have important differences. Salvage value is a commonly used, if not often discussed, method of determining the value of an item or a company as a whole. Investors use salvage value to determine the fair price of an object, while business owners and tax preparers use it to deduct from their yearly tax liabilities. ABC Company buys an asset for $100,000, and estimates that its salvage value will be $10,000 in five years, when it plans to dispose of the asset. This means that ABC will depreciate $90,000 of the asset cost over five years, leaving $10,000 of the cost remaining at the end of that time.

How is Salvage Value Calculated?

- Unless there is a contract in place for the sale of the asset at a future date, it’s usually an estimated amount.

- He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

- It spreads the decrease evenly over the asset’s useful life until it reaches its salvage value.

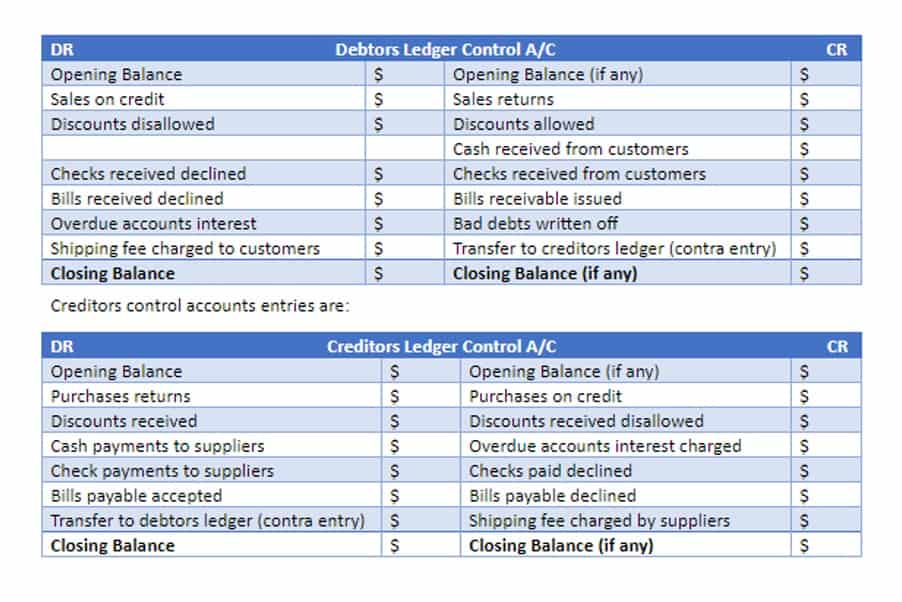

- The impact of the salvage (residual) value assumption on the annual depreciation of the asset is as follows.

- Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life.

- For example, car insurance rates after an accident the policyholder caused are typically higher.

- The majority of companies assume the residual value of an asset at the end of its useful life is zero, which maximizes the depreciation expense (and tax benefits).

Some companies may choose to always depreciate an asset to $0 because its salvage value is so minimal. State Farm also offers full coverage options for vehicles with rebuilt titles. There may be additional requirements to purchase a policy, including a photo inspection before coverage is issued.

How confident are you in your long term financial plan?

Accurately determining the salvage value is essential for calculating depreciation, understanding the total cost of ownership, and making informed financial decisions about asset purchases and disposals. After tax salvage value is like the retirement money for a company’s equipment. It’s what is salvage cost the amount a company thinks it will get for something when it’s time to say goodbye to it. Companies use this value to figure out how much to subtract from the original cost of the thing when calculating its wear and tear. It’s also handy for guessing how much money they might make when they get rid of it.

- John is the editorial director for CarInsurance.com, Insurance.com and Insure.com.

- Salvage value is the estimated resale value of an asset at the end of its useful life.

- This is often heavily negotiated because, in industries like manufacturing, the provenance of their assets comprise a major part of their company’s top-line worth.

- This may also be done by using industry-specific data to estimate the asset’s value.

- It is calculated by subtracting accumulated depreciation from the asset’s original cost.

- A depreciation schedule helps you with mapping out monthly or yearly depreciation.

Example of salvage value calculation for a car belonging to a business for after and before tax

For example, a bookkeeping delivery company might look at the value of its old delivery trucks for guidance. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. You can stop depreciating an asset once you have fully recovered its cost or when you retire it from service, whichever happens first.

If your vehicle is totaled, the insurance company will assess its salvage value. “Repairing a salvage vehicle can be worth it if the cost of repairs is significantly lower than the vehicle’s post-repair market value,” says John Crist, founder of Prestizia Insurance. The car salvage value calculator is going to find the salvage value of the car on the basis of the yearly depreciation value. When calculating the depreciation expense of an asset, the expected amount of the salvage value is not included. In accounting, salvage value is the amount that is expected to be received at the end of a plant asset‘s useful life. Salvage value is sometimes referred to as disposal value, residual value, terminal value, or scrap value.

Everything to Run Your Business

Therefore, the DDB method would record depreciation expenses at (20% × 2) or 40% of the remaining depreciable amount per year. An asset’s depreciable amount is its total accumulated depreciation after all depreciation expense has been recorded, which is also the result of historical cost minus salvage value. The carrying value of an asset as it is being depreciated is its historical cost minus accumulated depreciation to date. Some insurance companies impose a surcharge for insuring a salvage title car that has been rebuilt.