Journal entry for investment in shares of another company

Briefly indicate the accounting entries necessary to recognize the split in the company’s accounting records and the effect the split will have on the company’s balance sheet. What happens if the price increases from $40 per share to $50 per share tomorrow? Your balance sheet will show the cost of $2010 until the shares are sold or the accounting period ends. However, historically each share has a designated par value (sometimes referred to as face value, nominal value), which is a notional price per share below which the share cannot be issued. Accounting convention requires that the amount of capital stock relating to the price above par value must be shown separately as a premium on stock, usually referred to as paid in capital in excess of par value. The issued shares is the amount of authorized shares which the company has actually issued (sold) to shareholders in return for payment (usually cash).

Cash Flow Statement

Immediately after the purchase, the equity section of the balance sheet (Figure 14.6) will show the total cost of the treasury shares as a deduction from total stockholders’ equity. This journal entry will increase both total assets on the balance sheet and total revenues on the income statement as a result of the dividend received from the investment that we have in another company. Selling common shares to investors is a common method for companies to raise capital. This capital is used by the company to fund operations, invest in assets, and pay salaries. When a company issues common shares, it is selling ownership in the company to investors in exchange for cash. These investors then become shareholders, and their ownership stake in the company is based on the percentage of shares they hold.

Accounting Education

A primary motivator of companies invoking reverse splits is to avoid being delisted and taken off a stock exchange for failure to maintain the exchange’s minimum share price. A traditional stock split occurs when a company’s board of directors issue new shares to existing shareholders in place of the old shares by increasing the number of shares and reducing the par value of each share. For example, in a 2-for-1 stock split, two shares of stock are distributed for each share held by a shareholder. From a practical perspective, shareholders return the old shares and receive two shares for each share they previously owned. The new shares have half the par value of the original shares, but now the shareholder owns twice as many.

Reporting Treasury Stock for Nestlé Holdings Group

According to The Motley Fool, the Walt Disney Company bought back 74 million shares in 2016 alone. Read the Motley Fool article and comment on other options that Walt Disney may have had to obtain financing. Auditor’s statement is required that they have enquired into the company’s state of affairs.

Reissuing Treasury Stock above Cost

It can be a strategic maneuver to prevent another companyfrom acquiring a majority interest or preventing a hostiletakeover. A purchase can also create demand for the stock, which inturn raises the market price of the stock. Sometimes companies buyback shares to be used for employee stock options or profit-sharingplans. Just after the issuance of both investments, the stockholders’equity account, Common Stock, reflects the total par value of theissued stock; in this case, $3,000 + $12,000, or a total of$15,000. The amounts received in excess of the par value areaccumulated in the Additional Paid-in Capital from Common Stockaccount in the amount of $5,000 + $160,000, or $165,000. A portionof the equity section of the balance sheet just after the two stockissuances by La Cantina will reflect the Common Stock account stockissuances as shown in Figure 14.4.

🎓 Ready to Take Your Accounting Knowledge to the Next Level?

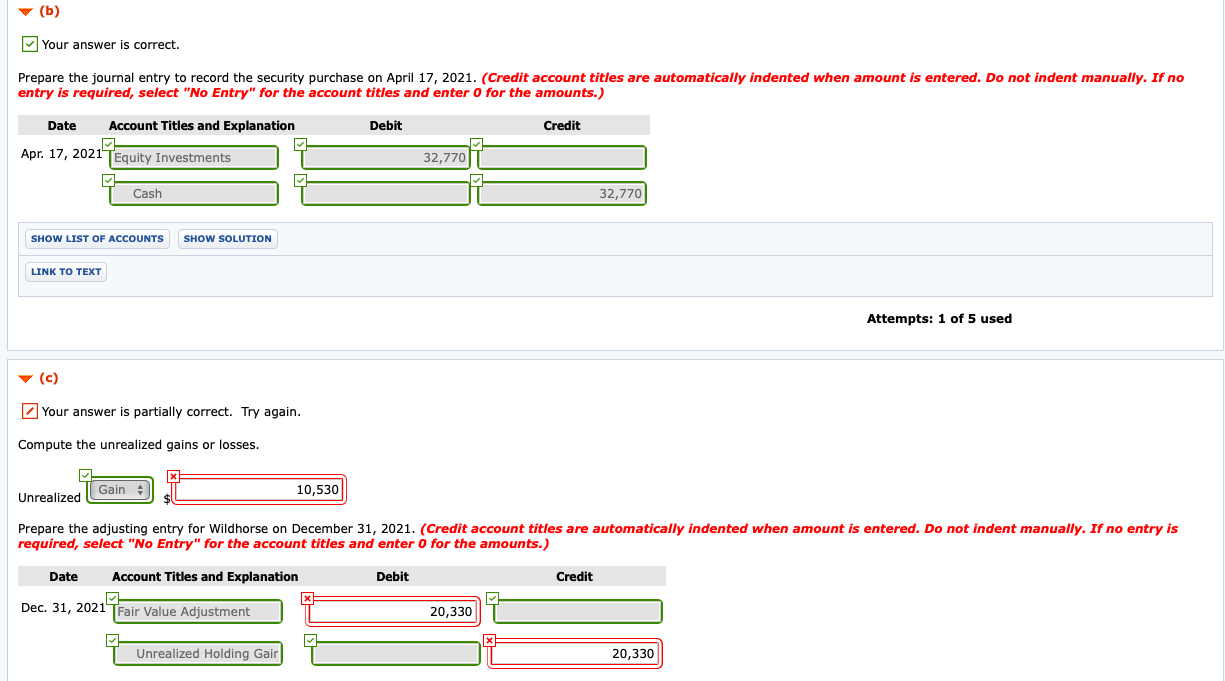

- In this journal entry, the stock investment account is an asset account on the balance sheet, in which its normal balance is on the debit side.

- This $200,000 investment in shares that we have bought represents 1% of shares of ownership in the ABC Corporation.

- The difference is recorded as a credit of $300 to Additional Paid-in Capital from Treasury Stock.

- In a 2-for-1 split, for example, the value per share typically will be reduced by half.

Finally, as in the bid by Mars to acquire Wrigley, the investor may seek to obtain a controlling interest in the other company. In many cases, one company even acquires 100 percent ownership of the other. Such acquisitions are actually common as large companies attempt to move into new industries or geographical areas, become bigger players in their current markets, gain access to valuable assets, or simply eliminate competitors. Many smaller companies are started by entrepreneurs with the specific hope that success will eventually attract acquisition interest from a larger organization. Often, a significant profit can be earned by the original owners as a result of the sale of their company.

When a company issues stock for property or services, the company increases the respective asset account with a debit and the respective equity accounts with credits. The applicable accounting procedures depend on the purpose for the ownership. If the investment is only to be held for a short period of time, it is labeled a trading security and adjusted to fair value whenever financial statements are to be produced. Any change in value creates a gain or loss that is reported within net income because fair value is objectively determined, the shares can be liquidated easily, and a quick sale is anticipated before a large change in fair value is likely to occur. Whenever trading securities are sold, only the increase or decrease in value during the current year is reported within net income since earlier changes have already been reported in that manner.

This $200,000 investment in shares that we have bought represents 1% of shares of ownership in the ABC Corporation. Because the sales price of these shares ($27,000) is less than the reported balance ($28,000), recognition of a $1,000 loss is appropriate. This loss reflects the drop in value that took place during Year Two. Investors, though, may also embrace a strategy what is the turbotax phone number of acquiring enough shares to gain some degree of influence over the other organization. Often, profitable synergies can be developed by having two companies connected in this way. For example, at the end of 2008, The Coca-Cola Company (CCC) held approximately 35 percent of the outstanding stock of Coca-Cola Enterprises (CCE), its primary bottler and distributor.

There is no change in total assets, total liabilities, or total stockholders’ equity when a small stock dividend, a large stock dividend, or a stock split occurs. Both types of stock dividends impact the accounts in stockholders’ equity. A stock split causes no change in any of the accounts within stockholders’ equity.

Ultimately, any dividends declared cause a decrease to Retained Earnings. Which means if you look at the balance sheet of McDonalds, you will not see how many bags of French fries are remaining at their storage facility, you will only see the total value at cost basis. I have created an account which corresponds to my account with a share broker. When I pay the broker money, I do a transfer from my bank account to the broker’s account, which leaves a cash balance with the broker. Tracking share purchases in a double-entry bookkeeping system goes outside my knowledge, and I would be glad of advice. You need to make an entry to record your purchase because your basis ($40K) is not the seller’s basis ($100).