Accounting Equation Basics, Example and Formula

This equation is the foundation of modern double entry system of accounting being used by small proprietors to large multinational corporations. Other names used for this equation are balance sheet equation and fundamental or basic accounting equation. Accounting equation shows the relationship between balance sheet items including assets, liabilities and owner’s equity, in which total assets always equal to total liabilities plus total owner’s equity. Due to this, the accounting equation is also called the balance sheet equation sometimes. The balance sheet is also known as the statement of financial position and it reflects the accounting equation. The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time.

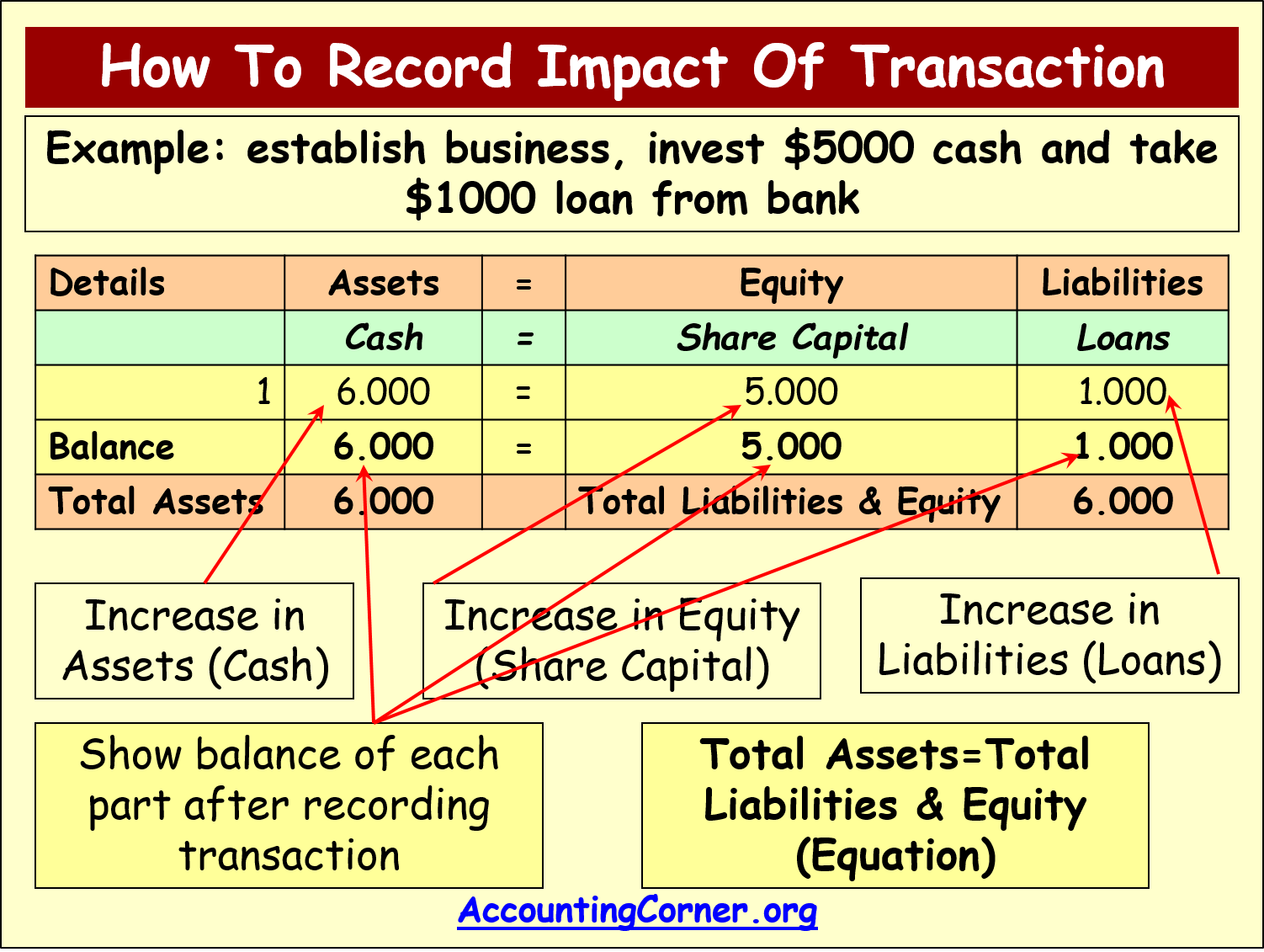

Effect of Transactions on the Accounting Equation

Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners. Understanding how the accounting equation works is one of the most important accounting skills for beginners because everything we do in accounting is somehow connected to it. The 500 year-old accounting system where every transaction is recorded into at least two accounts. Equity represents the portion of company assets that shareholders or partners own.

Get in Touch With a Financial Advisor

- The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof.

- $10,000 of cash (asset) will be received from the bank but the business must also record an equal amount representing the fact that the loan (liability) will eventually need to be repaid.

- To learn more about the balance sheet, see our Balance Sheet Outline.

- On 12 January, Sam Enterprises pays $10,000 cash to its accounts payable.

The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof. Total Assets must equal total Liabilities plus total Equity. So simply checking whether the Balance Sheet balance can tell you whether the statement is wrong.

The relationship between the accounting equation and your balance sheet

Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners. After the company formation, Speakers, Inc. needs to buy some equipment for installing speakers, so it purchases $20,000 of installation equipment from a manufacturer for cash. In this case, Speakers, Inc. uses its cash to buy another asset, so the asset account is decreased from the disbursement of cash and increased by the addition of installation equipment. Let’s take a look at the formation of a company to illustrate how the accounting equation works in a business situation. However, due to the fact that accounting is kept on a historical basis, the equity is typically not the net worth of the organization.

Income and retained earnings

Small business owners typically have a 100% stake in their company, while growing businesses may have an investor and share 20%. This concept helps the company to know where its assets (high level) come from and monitor its balance in the business. This is important as some companies may not be able to survive in the long term if their assets are mainly from liabilities while their equity is too small in comparison. This transaction brings cash into the business and also creates a new liability called bank loan. On 10 January, Sam Enterprises sells merchandise for $10,000 cash and earns a profit of $1,000. As a result of this transaction, an asset (i.e., cash) increases by $10,000 while another asset ( i.e., merchandise) decreases by $9,000 (the original cost).

Ask a Financial Professional Any Question

Analyze a company’s financial records as an analyst on a technology team in this free job simulation. Debt is a liability, whether it is a long-term loan or a bill that is due to be paid. Remember, the what are the risks of an accounting career total value of Assets must always equal the total value of Liabilities and Equity. Any Balance Sheet whose total Assets value does not equal the sum of its Liabilities and Equity values is wrong.

The accounting equation is also called the basic accounting equation or the balance sheet equation. Before technological advances came along for these growing businesses, bookkeepers were forced to manually manage their accounting (when single-entry accounting was the norm). Of course, this lead to the chance of human error, which is detrimental to a company’s health, balance sheets, and investor ability. To further illustrate the analysis of transactions and their effects on the basic accounting equation, we will analyze the activities of Metro Courier, Inc., a fictitious corporation. Refer to the chart of accounts illustrated in the previous section.

The balance sheet is also referred to as the Statement of Financial Position. Since the balance sheet is founded on the principles of the accounting equation, this equation can also be said to be responsible for estimating the net worth of an entire company. The fundamental components of the accounting equation include the calculation of both company holdings and company debts; thus, it allows owners to gauge the total value of a firm’s assets. We know that every business holds some properties known as assets. The claims to the assets owned by a business entity are primarily divided into two types – the claims of creditors and the claims of owner of the business.

The following illustration for Edelweiss Corporation shows a variety of assets that are reported at a total of $895,000. Creditors are owed $175,000, leaving $720,000 of stockholders’ equity. Income and expenses relate to the entity’s financial performance.

But its Cash & Cash Equivalents value decreases by $100 because it used $100 to buy the chair. The $100 increase in PP&E is offset by the $100 decrease in Cash & Cash Equivalents. This arrangement is used to highlight the creditors instead of the owners. So, if a creditor or lender wants to highlight the owner’s equity, this version helps paint a clearer picture if all assets are sold, and the funds are used to settle debts first.