Greatest Gaming Crypto Cash With 100x Roi In Three Months: The Revolution Of Blockchain Gaming

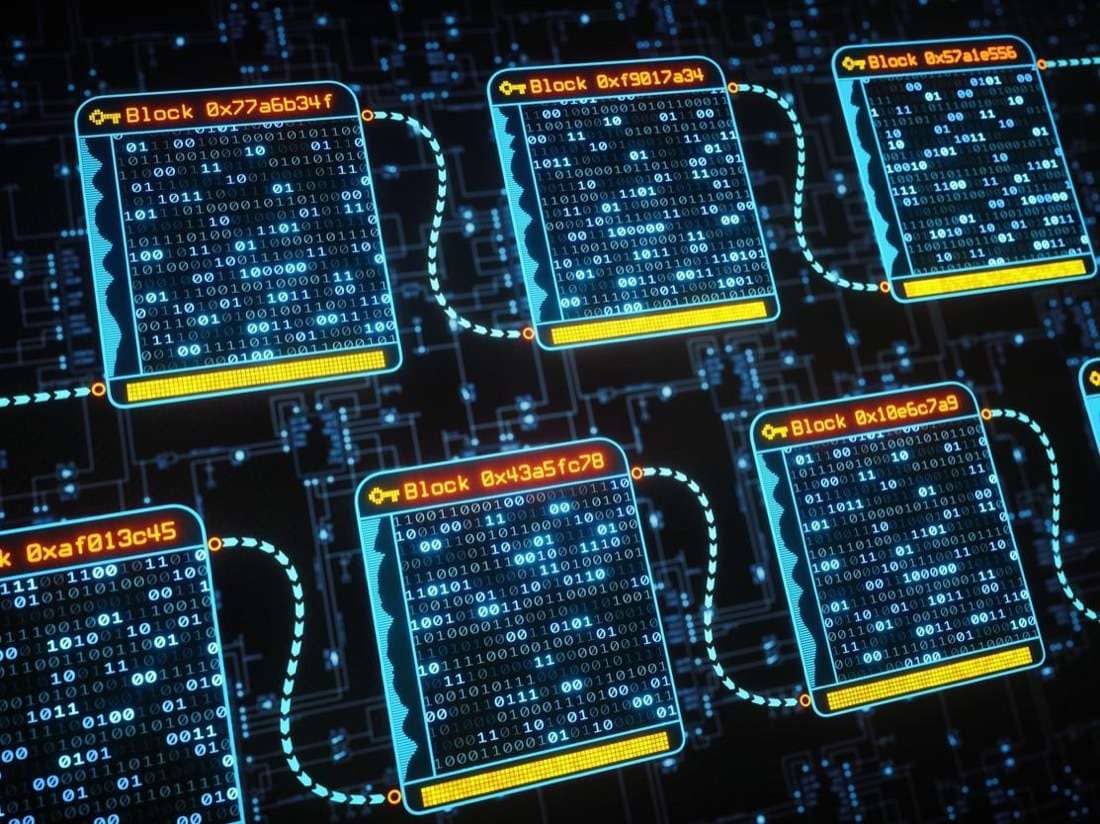

This tech acts as a single-layer, source-of-truth that’s designed to track every transaction ever made by its users. This immutability protects towards fraud in banking, leading to faster settlement times, and offers a built-in monitor for money laundering. Banks also benefit from quicker cross-border transactions at reduced prices and high-security knowledge encryption. IBM Blockchain options use distributed ledger expertise and enterprise blockchain to help shoppers drive operational agility, connectivity and new revenue streams. Move beyond your organization’s boundaries with trusted end-to-end knowledge public and private blockchain difference trade and workflow automation. A non-public blockchain is “permissioned,” which means just some individuals are allowed to take part in it.

The Function Of Data Analytics In Cybersecurity

- Drawbacks may embody the substantial computational power that’s required, little or no privateness for transactions, and weak security.

- It has excessive potential in businesses, banks, and different payment processors.

- No participant can change or tamper with a transaction after it’s been recorded to the shared ledger.

- Once a block has been added, it can be referenced in subsequent blocks, but it might possibly’t be modified.

- These built-in protocols maintain all in-network nodes in agreement on a single information set.

Consortium blockchains, also called federated blockchains, are permissioned networks which are operated by a choose group. Multiple customers have the facility to set the foundations, edit or cancel transactions. With shared authority, the blockchain might take pleasure in a better price of efficiency and privateness. As blockchain networks grow in reputation and usage, they face bottlenecks in processing transactions shortly and cost-effectively.

Blockchain Adoption Considerations

Transactions are objectively licensed by a consensus algorithm and, unless a blockchain is made non-public, all transactions could be independently verified by users. A private blockchain is permissioned.[53] One can’t be a part of it unless invited by the community administrators. Since every block contains information about the previous block, they effectively kind a series (compare linked record knowledge structure), with each further block linking to those before it. Consequently, blockchain transactions are irreversible in that, once they are recorded, the info in any given block cannot be altered retroactively without altering all subsequent blocks. Another major difference is that it’s sort of centralized as just one authority seems over the community.

What’s A Blockchain In Straightforward Terms?

Confirmation takes the community about one hour to complete as a result of it averages slightly below 10 minutes per block (the first block along with your transaction and 5 following blocks multiplied by 10 equals 60 minutes). The nonce worth is a field within the block header that is changeable, and its worth incrementally will increase with every mining attempt. If the ensuing hash is not equal to or less than the goal hash, a value of 1 is added to the nonce, a brand new hash is generated, and so on. The nonce rolls over about each four.5 billion makes an attempt (which takes lower than one second) and makes use of another worth referred to as the additional nonce as an extra counter.

Key Options Of Blockchain Expertise

In the true world, the energy consumed by the hundreds of thousands of units on the Bitcoin network is more than the country of Pakistan consumes yearly. Embracing an IBM Blockchain solution is the fastest way to blockchain success. IBM convened networks that make onboarding easy as you be a part of others in reworking the food provide, supply chains, trade finance, monetary services, insurance, and media and advertising. A public blockchain is one that anyone can be a part of and participate in, such as Bitcoin. Drawbacks may embody the substantial computational energy that’s required, little or no privateness for transactions, and weak safety. These are essential concerns for enterprise use cases of blockchain.

Consortium blockchains, therefore, take pleasure in extra decentralization than private blockchains, leading to larger ranges of safety. All digital belongings, together with cryptocurrencies, are primarily based on blockchain expertise. Decentralized finance (DeFi) is a gaggle of purposes in cryptocurrency or blockchain designed to switch present financial intermediaries with good contract-based providers.

The IBM Blockchain Platform is powered by Hyperledger know-how.This blockchain solution may help turn any developer right into a blockchain developer. Vertrax and Chateau Software launched the primary multicloud blockchain solution constructed on IBM Blockchain Platform to assist prevent provide chain disruptions in bulk oil and gas distribution. IBM Food Trust is helping Raw Seafoods increase belief throughout the food supply chain by tracing every catch right from the water — all the way to supermarkets and restaurants. Blockchain creates belief as a end result of it represents a shared report of the reality. Data that everyone can consider in will assist energy other new applied sciences that dramatically improve efficiency, transparency and confidence. No participant can change or tamper with a transaction after it’s been recorded to the shared ledger.

This permits seamless and safe sharing of medical information, bettering therapy outcomes and decreasing administrative burdens. A motivated group of hackers might leverage blockchain’s algorithm to their benefit by taking control of greater than half of the nodes on the network. With this straightforward majority, the hackers have consensus and thus the ability to verify fraudulent transactions.

In September 2022, Ethereum, an open-source cryptocurrency network, addressed concerns about energy usage by upgrading its software structure to a proof-of-stake blockchain. Known merely as “the Merge,” this event is seen by cryptophiles as a banner moment in the historical past of blockchain. With proof of stake, traders deposit their crypto coins in a shared pool in change for the possibility to earn tokens as a reward.

Retail also can streamline its processes with hybrid blockchain, and highly regulated markets like monetary providers can also see benefits from using it. One of the big advantages of hybrid blockchain is that, as a result of it works inside a closed ecosystem, outside hackers cannot mount a 51% attack on the community. It additionally protects privateness however permits for communication with third parties. Transactions are low cost and quick, and it offers higher scalability than a public blockchain community.

This kind of blockchain is controlled by an organization or group, which determines who is granted access and permits learn and write access to permissioned users on the network. The dimension of the non-public blockchain is generally smaller as a outcome of it’s a restrictive surroundings. As such, a private blockchain functions throughout the network of the controlling entity. Its public nature also means that it cannot be used for businesses within the non-public sector. Also, public blockchains can be costly to handle because it requires nodes to behave as a miner and run both Proof-of-Work(PoW) and Proof-of-Stack(PoS).

Because access to the network is restricted, there are fewer nodes on the blockchain, resulting in much less processing time per transaction. Smart contracts are some of the necessary features of blockchain know-how. They function routinely according to predefined rules and circumstances.

People have to take permission from the authority which is managing this blockchain to affix, if permission shall be granted then folks can be part of and contribute to that network. It is generally used by organizations the place they be positive that folks can change, renew and delete knowledge. It prevents an organization’s information from unwanted individuals and that is what the organization wants. Every organization needs that their data ought to be secure and by noway their competitor accesses their information. Public blockchains are permissionless in nature, allow anybody to affix, and are utterly decentralized. Public blockchains permit all nodes of the blockchain to have equal rights to entry the blockchain, create new blocks of data, and validate blocks of data.

This managed strategy ensures adherence to regional and industry-specific rules, allowing entities to leverage blockchain benefits without compromising on regulatory necessities. In distinction, personal blockchains prohibit entry to a particular group or group. Participants in a non-public blockchain are known entities requiring permission to hitch. This type is advantageous in situations where privacy and control are paramount, similar to within enterprises or consortia. While providing enhanced management, the drawback is a lowered stage of decentralization in comparison with public blockchains.

All network individuals have access to the distributed ledger and its immutable record of transactions. With this shared ledger, transactions are recorded only as soon as, eliminating the duplication of effort that’s typical of conventional business networks. Finally, we have the final blockchain technology sorts – Hybrid blockchain. If you wish to get all some great advantages of each personal and public blockchain with minimal disadvantage, you need to go for this blockchain. So, in case you are a person who needs to introduce a model new international cryptocurrency, then this may be for you!

Read more about https://www.xcritical.in/ here.